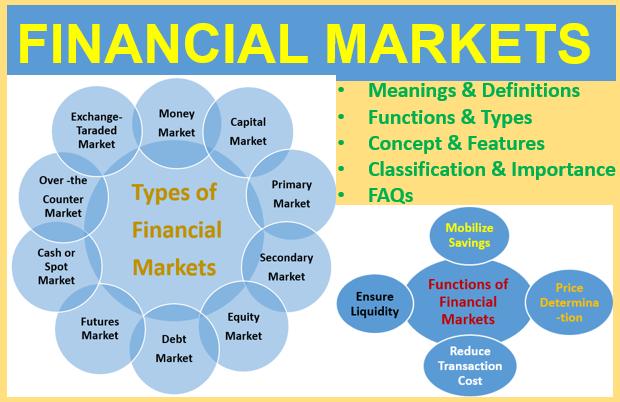

Functions of Financial Markets: The most important functions and purposes of financial markets are to mobilise savings from individuals, determine the price of financial assets or instruments, ensure the liquidity of assets, and reduce the time and cost of transactions. In this article, we have explored in detail ‘what are financial markets’, their meaning, definition, concept, features, composition, functions, types, classification, and importance & FAQS related to functions of financial markets.

Table of Contents

What are Financial Markets?

The words ‘financial markets’ refer to the places or systems that provide traders i.e. buyers and sellers the means and mode to trade financial assets or instruments such as bonds, equities, international currencies, and derivatives. In other words, the financial markets include different smaller marketplaces such as the stock market, the bond market, the forex market, the commodities market, and the derivatives market.

One of the functions of financial markets is to facilitate the transactions of capital between sellers and buyers, those who need capital with those who have capital to invest. The financial markets in addition to raising capital, also allow participants to transfer risk usually through derivatives and promote commerce.

A financial asset is a liquid non-physical asset that gets its value from a contractual right or ownership claim, for example- cash, stocks, bonds, mutual funds, companies’ shares, and bank deposits. It is generally more liquid than other physical or tangible assets like land, property, commodities, or real estate etc. And financial assets’ value reflects factors of supply and demand in the marketplace in which they trade, as well as the degree of risk they carry.

What is the Meaning of Financial Markets?

Meaning of Financial Markets: A place or platform where individuals are involved in any kind of financial transaction is known as the financial market. The meaning of financial market points out a platform where buyers and sellers are involved in the sale and purchase of financial products like shares, mutual funds, bonds, securities, and so on. Often, they are called by different names, including “Wall Street” and “capital market,” but all of them still mean one and the same thing.

The stock market in a financial market allows investors or buyers to purchase companies’ shares and sellers to sell their shares. A company issues new stocks which are first offered in the primary stock market whereas stock securities are sold and purchased in the secondary stock market. We will discuss the functions of financial markets later on and first discuss the definition of financial market below.

Important Articles

IAS Full Form: history, Salary and 29 Central Govt. Jobs |

What is the Definition of Financial Markets?

Definition of Financial Markets: A financial market is defined as a medium or means through which financial instruments or assets are sold and purchased, enabling sellers and buyers to consult and allow exchanges. The term financial market is used in different ways – it refers to physical places, virtual places or exchanges or sellers and buyers who are interested in making transactions.

“Financial market is defined as a means by which trade of financial assets takes place between buyers and sellers either directly or through agents or institutions.” __ Dr. Md. Usmangani Ansari

What is the Concept of Financial Markets?

Concept of Financial Markets: To understand the structure, functions, and the importance of financial markets, you first understand how the functions of financial markets play their role in our economy. As every economy has two basic sectors related to funds – savings and investment. Savings is what an individual saves money and keeps in a bank. Whereas investment is the capital that industries or businessmen require to start, run, and expand their businesses.

The concept of financial markets is related to our economy which provides a link between savings and investments either through the banks or stock markets. One way to convert savings into investment is through banks. And other ways to convert savings into investments is through financial markets. For example some people use their individual savings to buy financial instruments and commodities such as shares, stocks, debentures, etc. of a company or some industries through the financial markets. This is the concept of financial markets.

Functions of financial markets serve an allocative function and mobilize inactive funds to be put to more productive use. When an inactive fund is allocated in right way in productive places, there are some added benefits come, like:

- The rate of return on their savings will be higher here for investors, than what a bank offers.

- The funds or savings will be invested in firms that have high productivity and show great promise in the economy.

Thus businessmen and investors go to financial markets to raise money to grow their business and to make more money, respectively.

For making the concept and functions of financial markets more clear, we can take an example of a bank where individuals have savings accounts. The bank uses their money to loan to other individuals, businessmen, and organizations at a fixed interest rate which is usually more than the interest rate the account holders get. Here both the depositors as well as banks earn and see their money grow through the interest. Hence, the bank serves the role and functions of financial markets that benefits both the depositors and the debtors.

Features of Financial Markets?

Features of Financial Markets: Financial markets are as essential and important to the economy of a country as blood is to a living body. Let’s know the features of financial market below:

Link Between Investors and Borrowers: Financial markets act as a link between investors and borrowers and bridge the gap between them for mutual benefits.

Easily Available to Traders: Financial markets are easily available all the time for the investors and fund raisers (borrowers).

Facilitate Trading in Marketable and Non-marketable Securities: Financial markets facilitate trades i.e. buying and selling of marketable and non-marketable securities (assets or commodities). Marketable securities are bonds, debenture, shares, etc. whereas non-marketable securities are post office deposits, bank deposits, loans and advances.

Controlled by Government Rules and Regulations: Financial markets’ operations are controlled by the government rules and regulations.

Need Financial Intermediaries: For the functions of financial markets there is a need for financial intermediaries like banks, non-banking financial companies, mutual fund companies, stock exchanges, insurance companies, brokers, etc.

Deals in Short-term and Long-term Investment: Financial markets deal in short-term and long term investment where investors put their funds into different securities and schemes for financial benefits.

Composition of Financial Markets

Composition of Financial Markets: Financial markets comprises 2 types of institutions or financial bodies, one is depository institutions and other is non-depository institutions.

Depository Institutions

Depository institutions are those financial bodies which facilitate deposits of savings from individuals and organizations. These depository institutions further invest the depositors’ funds either as loans to borrowers or into debt instruments in the debt market. Generally, there are four types of depository institutions that work like functions of financial markets as given below:

- Commercial Banks

- Mutual Saving Banks

- Credit Co-operative Societies

- Savings and Loan Associations

Non-Depository Institutions

Non-Depository institutions act as the functions of financial markets but only as financial intermediaries not as banks. The non-depository institutions also manage the risk of loss. These non-depository institutions include the followings:

- Mutual Fund Companies

- Pension Fund Institutions

- Insurance Companies

- Brokerage Firms

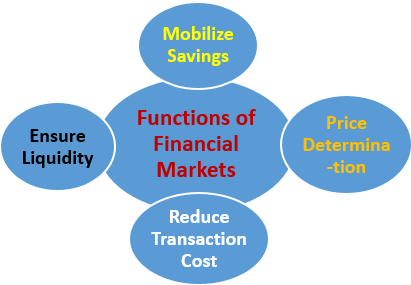

What are the Functions of Financial Markets?

Functions of Financial Markets: The financial markets play a very significant role in the success, strength, and progress of a country’s economy. To make the economy stable and develop some essential functions of financial markets are discussed below.

- Financial Markets Enable the Mobilization of Money and Savings

- Help in Price Determination of Assets

- Ensure Liquidity of Assets

- Save Time and Money by Reducing Transaction Cost

- Make Capital Formation

- Create New Assets and Liabilities

- Determine the Rate of Capital Formation, and

- Accelerate Economic Development of the country

Mobilize Money and Savings: The most essential functions of financial markets are to mobilize idle i.e. unused savings for investment in better ways at profitable places or in financial instruments. Thus, the financial markets function as a link between individuals and businesses which require capital from the savers.

Help in Assets’ Price Determination: One of the important functions of financial markets is to determine the price of an asset by considering its demand and supply. As the demand and supply are the two most important forces which drive global economic systems constantly and consistently. Because an economy can not exist in balance without the forces of demand and supply. And financial markets are so controlled by demand and supply and affect the price of the financial assets being traded.

Ensure Liquidity of Assets: Financial liquidity is a phenomenon that determines the ability of an asset to be how easily and quickly sold, purchased, or converted to cash. For example, gold is considered as the most liquid form of investment that can be quickly sold and converted to cash, because of its high demand. Likewise, one of the most significant functions of financial markets is to ensure liquidity of financial assets.

Save the Time and Cost of Transactions: One of the functions of financial markets is to provide required information about the financial assets or instruments free of cost, and the reduced cost and fees charged for each transaction due to online e-marketing.

Important Articles

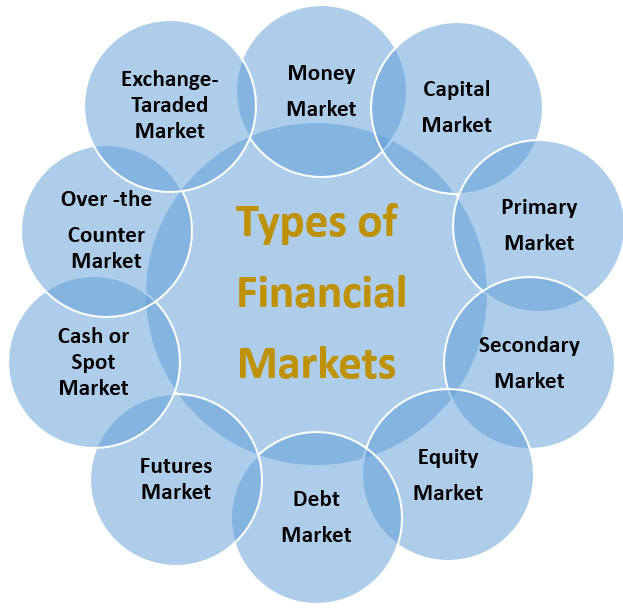

What are the Types of Financial Markets?

Any type of market which deals in financial assets or instruments is known as financial markets. There are so many types of financial markets, some are small and others are big and internally known like the New York Stock Exchange (NYSE). The NYSE is one of the biggest stock markets in the world that trades trillions of dollars in a day. The different types of financial markets are as follows:

- Stock Markets (Secondary Markets)

The financial markets where the individuals, brokers, banks, companies, and other parties perform trading of existing securities which are already previously issued are called secondary markets. The secondary market is commonly called the stock market.

In the stock markets different companies and business firms make listings of their shares which are traded by investors (buyers) and sellers. Stock Markets allow companies to increase their capital through the Initial Public Offering (IPO). Thus stock markets facilitate trading of shares i.e. ownership of public companies.

Each share has a price of money and investors make profits by purchasing a share at a low price and selling when the price rises. But it is possible only when the shares of that company perform well in the market. Therefore, the investors should choose the right stocks that have probability of performing well in future.

How many stock exchanges are in India?

There are a total of 23 stock exchanges in India. Two of them are national level stock exchanges, namely National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The 21 others are regional stock exchanges.

Q. Which is the biggest stock exchange in India?

The National Stock Exchange of India (NSE) is India’s biggest stock exchange i.e. financial market. The NSE was incorporated in 1992, which ranked fourth in the world by equity trading volume.

Q. What is the full form of Sensex?

Stock Exchange Sensitive Index is the full form of SENSEX. SENSEX of India is the oldest stock exchange in the country which is also known as Bombay Stock Exchange (BSE). It is a free floating and economy-weighted index of 30 very big and financially sound and very well-established companies listed on BSE.

2. Money Markets

The financial market that provides very short-term loans having a maturity period within a year of issue is known as a money market. Thus, the money market trades in holdings and deposits with higher liquidity and safer investment. That is why the interest return is cheaper in the money market.

3. Capital Markets

The Financial Markets which provides a platform for the trading of medium and long-term financial assets and instruments between the individuals and financial institutions are termed as capital markets.

4. Primary Markets

When the listed companies or firms issue new securities, or new companies take entry with new stocks in a financial market that market is termed as a primary market.

5. Equity Markets

Those financial markets are equity markets which deal in financial assets or instruments or securities whose values keep on fluctuating and the securities holder receives the amount that becomes on the date of redemption.

6. Debt Markets

The debt market is a financial market which allows the trading of debt instruments or instruments with fixed interest rates like fixed deposits, bonds, debentures.

7. Cash or Spot Markets

The financial market where the trading or transactions of financial assets or instruments are done on the spot immediately is called a cash market.

8. Futures or Forward Markets

The futures markets are the financial markets where the execution of a transaction takes place on a future date. It is the opposite of a cash market. In this case, the price of assets or securities or transaction value is fixed at present to minimize the risk or loss to either party.

9. Over-the-Counter Markets

Over-the-Counter market is an unregulated market where trading of different securities like exotic options and derivatives, credit derivatives, swaps, forward contracts are made directly between the two parties without participation of any intermediaries.

10. Exchange-Traded Markets

Unlike an Over-the-Counter, the exchange-traded market is a financial market where trading of put, call, and futures options happen on an organized futures exchange in a systematic manner.

Classification of Financial Markets

Competitive aspirants and students trying to know the “what are the types of financial market or functions of financial markets” should also learn about how the financial markets are classified. The classification of financial markets are divided into the following sections:

- By Nature of Claim

(i) Debt Markets – These markets offer trading and fixed claims of debt instruments

like fixed deposits, bonds, and debentures. The investors who want a fixed return

after a fixed maturity period, prefer investing in debt markets and buy different

financial holdings.

(ii) Equity Markets: The equity markets allow trading in stocks or financial holdings

which are designed for residual claims or claims on redemption’s date.

- By Maturity of Claim

(i) Money Markets: These markets provide an opportunity to invest for a short-term

period where funds like treasury bills, a certificate of deposits, and commercial

papers, etc. mature within a year. The trading or investment can be done online

because money markets are usually not available physically.

(ii) Capital Markets: The capital markets are divided into primary and secondary

markets. The primary markets permit newly listed companies at stock exchange to

issue new securities and old listed companies to issue new shares. While secondary

markets allow the securities which are issued earlier to be exchanged or traded among

investors. The capital markets are risky in return so it is preferred for medium and long

term investment or trade through stockbrokers, insurance companies, commercial

banks, underwriters, etc.

3. By Timing of Delivery

(i) Cash Markets: The cash markets offer the sale and buy of financial assets or

instruments between different traders on the spot immediately.

(ii) Futures Markets: These markets offer trade of financial assets where

settlements and delivery or compensation of market products are taken in the future

specified date.

- By Organizational Structure

(i) Exchange-Traded Markets: These are centralized trading Markets of financial

instruments which record huge buy and sell transactions daily. These markets have a

standard patterned procedure which regulates their functioning while trading financial

holdings such as shares.

(ii) Over-the-Counter Markets: These are financial markets which have decentralized

organizations with customized procedures. Traders sell and buy financial holdings,

typically shares from small companies without involving any intermediaries i.e. brokers in their transactions. These markets offer trading facilities online.

What is the Importance of Financial Markets?

The financial markets are the base on which the economy of a country and global economy can grow and develop if well structured and managed strategically. There are many more importance of financial markets pdf such as:

- Financial markets provide a platform for businesses where traders i.e. buyers and sellers of financial instruments, irrespective of their size, will receive fair and proper treatment.

- These markets offer an opportunity to individuals, companies, and government organizations to raise funds (capital) for both short and long-term investments.

- The prices of financial assets or instruments are decided by market forces i.e. traders through demand and supply mechanisms.

- The role and functions of financial markets are very important for the mobilization of investors’ savings for productive uses.

- Financial markets create job opportunities which help lower the unemployment rate in the population of economic knowledge.

- These platforms provide financial funds at lower interest rates than loans a commercial bank gives.

- Companies are free to raise financial funds from the financial markets as required until their authorized shares are exhausted or used up.

- Intermediaries of financial markets provide financial and strategic advice to both investors and debtors i.e. funds raiser.

- Financial markets are important as they provide finances to hire manpowers, further invest in expansion and grow. For example, Apple in spite of having great ideas, it started in a garage in California. In 1977 it persuaded an investor for $250000 funds and now it is of more than 100 billion dollars worth with 100000 employees.

- Financial markets help in providing a platform for both sellers and buyers for the trade of financial assets.

- These markets are the place where investors can liquidate their financial securities as per their needs.

An efficient functions of financial markets play an important role in serving the following purposes:

- Financial markets are important because of their transparent pricing, simple trading rules, costs and fees.

- The continuous rise in stock exchange motives companies to hire more employees, thus decreasing unemployment. As a result produce mor disposable income to the common people of a country.

- Financial markers minimize risks by some strategies like hedging or diversification of funds.

- Reflecting the economic conditions of a nation thus acts as a mirror of the national economy.

- These have become a means to judging points on how the national and global economies are performing in the present scenario.

FAQs on Functions of Financial Markets

Q. What are the four functions of financial markets?

Ans. The four main functions of financial markets are:

- To Mobilize savings and channelize them into most productive use.

- To help in price discovery.

- To provide liquidity to financial assets and instruments.

- To reduce the fees and cost of transactions.

Q. What are the 4 types of financial markets?

Ans. The types of financial markets are:

- Stock market

- Capital market

- Money market

- Bond market

Q. What is the classification of financial markets?

Ans. The classification of financial markets are:

- By Nature of Claim

- By Maturity of Claim

- By Timing of Delivery

- By Organizational Structure

Q. What is the primary and secondary market?

Ans. The primary market is the financial markets where securities are created, and where securities are traded called secondary markets. Companies sell their new stocks and bonds like an initial public offering (IPO).

Q. What are the functions of financial markets Class 12?

Ans. Financial markets class 12 are the markets which help in assets creation and exchange of securities to provide short, medium and long term business finance.

Q. What are the 5 roles of financial markets?

Ans. The 5 roles of financial markets are:

- Provide finances to small, medium, and large companies for development and growth.

- Ensure a low cost of transactions and information,

- Give liquidity of stocks by providing a mechanism for an investor to sell the financial assets,

- Provide security to financial assets, and

- Give facilities for interaction between the investors and the borrowers.

This Post Has One Comment

Pingback: What Is A Financial Asset: A Comprehensive Guide — Competitive Career Exams